EIN/Federal Tax ID Number: 20-8273235

Tax Status

Ocean River Institute, Inc. is a tax-exempt not-for-profit organization as described in section 501©(3) of the Internal Revenue Code. Donations and bequests to Ocean River Institute are tax-deductible as allowed by law, for income, gift, and estate tax purposes.

Ocean River Institute acknowledges the market value of appreciated securities, mutual funds, bonds, or similar assets at the time of the transaction. The Ocean River Institute account manager will sell gifted assets soon after receipt.

Use of Materials

The materials at this Site are copyrighted, and any unauthorized use of any materials at this Site may violate copyright, trademark, and other laws. You may request the reprint usage of text and/or graphics from this Site by contacting Ocean River Institute. The materials at this Site are provided without any express or implied warranty of any kind.

This educational information is not intended as legal, tax, or investment advice. Please consult an attorney or professional advisor about your specific situation.

Ocean River Institute

12 Eliot Street

Cambridge, MA 02138

617 945-1552

info@oceanriver.org

Ocean River Institute Fund

at the Essex County Community Foundation

ORI’s Community Foundation Partner

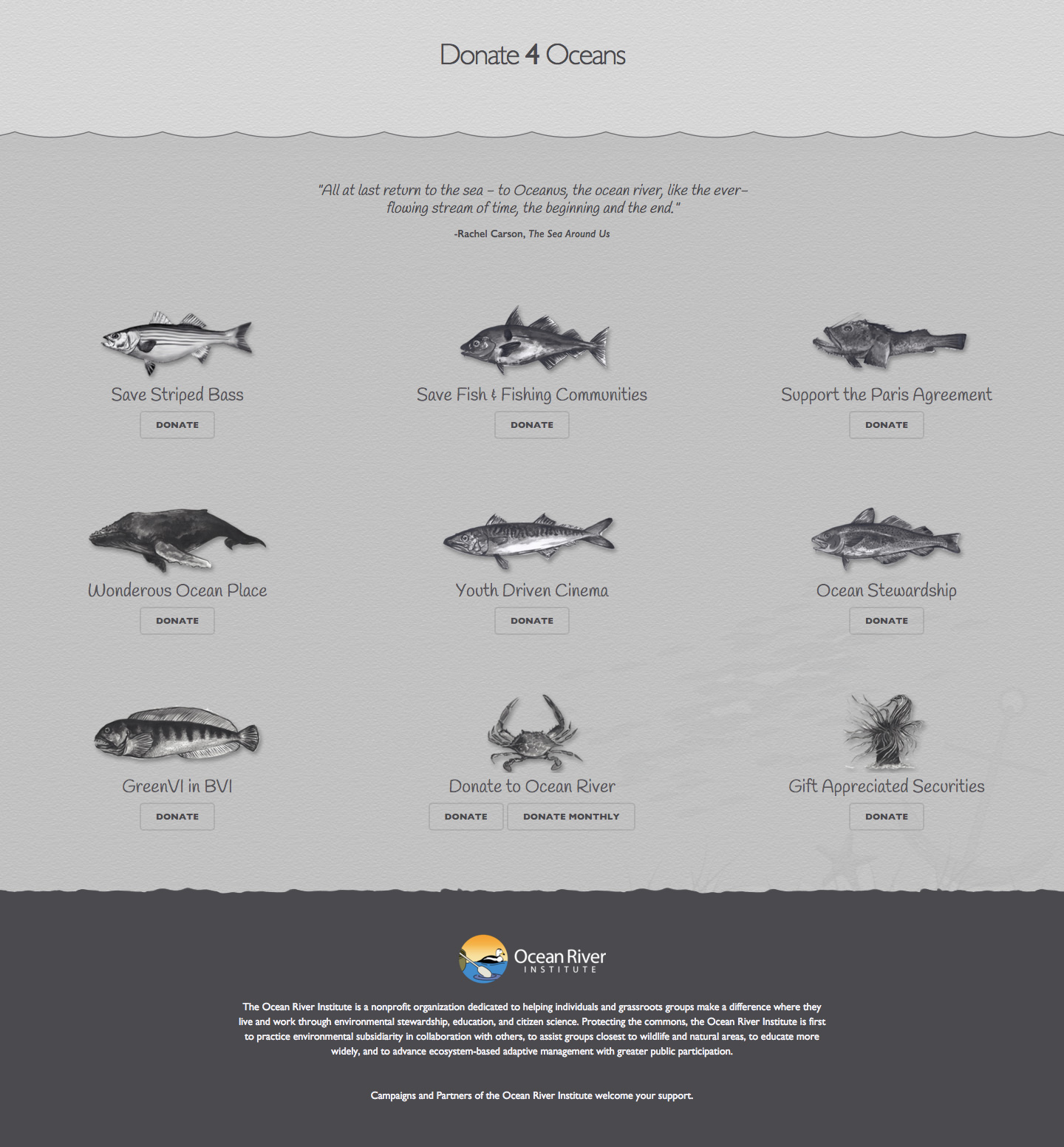

Gifts of Appreciated Securities

You can secure significant tax advantages by making a gift of securities – stocks, bonds, and mutual funds. A gift of stock held longer than one year allows you to avoid paying capital gains tax. You also receive an income tax deduction for the current market value of the gift, deducting gifts totaling up to 30% of your adjusted gross income in any year, with a five-year carryover for any excess. To gift securities to the ORI Fund, you are welcome to call Essex County Community Foundation at 978-777-8876.